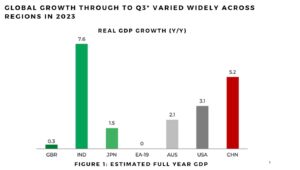

Global Growth Through to Q3 varied widely across regions in 2023

Introductory Comments

The 2023 calendar year delivered several positive surprises across markets and economies. On the economic front, the US avoided what was a much-anticipated recession. In our 2023 outlook, we wrote: “Overall, our view is that global growth will slow further in 2023 and that a shallow recession cannot be ruled out in the US and Europe.” This view was predicated on the view that the long and variable lags of monetary policy were yet to be felt.

We had already begun to see a drawdown in personal savings and a rise in credit card debt. However, the paths taken by the US economy and the broader European economy were very different throughout the course of the year. Not only did the US avoid recession, but it gradually accelerated. Both Europe and the US implemented further increases in policy rates during 2023 and appear to have concluded their rate-hiking cycles. However, Europe was less capable of weathering the increase in borrowing costs and its growth slowed to a crawl. Prior to 2023, both regions had responded to the pandemic with coordinated fiscal and monetary accommodation. For the US, it was clearly the case that multiple layers of government had overstimulated both businesses and households. The labour market remained tight and an extended period of ultra-low interest rates allowed businesses to borrow very cheaply over longer-than-usual maturities. At the same time, booming cash balances were benefiting from high short-term money market rates.

This culminated in the seemingly unprecedented outcome of improving net interest payments by companies. In a similar vein, periods where financial conditions had tightened considerably were soon followed by a prolonged easing, often resulting in financial conditions that were looser than the starting point. We saw several cycles follow this path and by year end 2023, financial conditions were virtually no tighter than when the Fed began hiking interest rates in March of 2022. This raises the question of whether monetary policy lags are still to come or were merely fleeting.

In Australia, inflation seems more entrenched than elsewhere, but this may be a timing issue as Australia has trailed developed nations by as much as six months on this front. Strong government spending, solid wages growth and high net overseas migration have fuelled the demand side of the economy. Yet, inflationary expectations remain well anchored over the medium term and provided productivity growth picks up, labour costs are less likely to add to inflation pressures.

In terms of risks, services inflation has been slower to fall, but we note this is consistent with other developed economies. Lower income cohorts came under immense cost pressures around housing and other necessities, while older and higher paid sections of the community often benefited from the higher interest rate environment.

As we peer into what might lie ahead in 2024, we note the potentially destabilising effects of growing geopolitical tensions around the world. In terms of renewed inflation risks, shipping costs have shifted higher and delays are beginning to build. However, the current downward inflation trajectory remains intact. For the US, signs of an imminent recession appear limited, with easing financial conditions and continued robust labour markets overall. A prolonged, albeit shallow, manufacturing recession now appears to have ended and the services sector retains its momentum on the back of solid wage growth.

Elsewhere, Europe is confronting higher recession risks, while China faces ongoing structural challenges. Multi-decade interest rate highs in Europe will begin to weigh on construction activity and maintain the current dampener on the services sector. This should help services inflation to moderate, but until reduced living costs become a reality and the ECB begins lowering rates, growth is likely to remain muted. In China, property sector woes look set to continue and in the absence of a stronger policy response, growth will remain sporadic.

The outlook for Australia is also murky as it emerges from a per capita recession. The growth impetus from record migration flows is expected to partly reverse in 2024, but the household sector remains mired in record debt and wealth inequality appears to be widening. It looks likely that younger and lower income cohorts will continue to struggle throughout 2024 as wage growth slows and unemployment rises. This will likely result in interest rate moves trailing other developed nations both in quantum and timing.

0 Comments